It’s not just about buying a house—it's about lighting your way home.

Ready to make your homeownership dreams a reality? Luminate Bank is here to help you navigate the path to the right mortgage, from start to finish, with expertise, guidance, and a commitment to making the process smooth and clear.

Hi, I'm Ken!

Whether you are a first time home buyer or purchasing a multi-million dollar home, you have found the right person. Ken Venick has over 30 years of experience in the mortgage loan business and can put you or your client in the right mortgage loan product for their unique needs.

- Looking to purchase a home?

- Looking for a lower rate on your current mortgage?

- Looking to consolidate debt?

- Looking to do home improvements?

- Looking for a reverse mortgage?

We are your one-stop-shop to handle of all your mortgage needs.

We are locally owned and operated which means we don’t have the overhead of national firms. This allows us, in most cases, to save you money. And because we are the lender, it allows us to close your loan faster. Please call Ken Venick to start your loan today.

>> Our Products

Conventional Loans

Conventional loans are a solid choice for many homebuyers, offering flexibility in property types, fee structures, and loan terms—perfect for those who want options.

FHA Loans

FHA loans make homeownership more accessible for low-to-moderate income buyers or those with less-than-perfect credit. With smaller down payment requirements and easier qualifications, FHA loans help open the door to homeownership for many.

VA Loans

VA loans honor our veterans and active service members by making home loans more accessible. If you’ve served in the military, a VA loan could be the ideal way to simplify your home-buying journey.

USDA Loans

USDA loans are designed for those looking to purchase in rural areas. Offered by the USDA, this option supports rural homebuyers with lower incomes, helping them find a place to call home where it matters most.

“I had an excellent experience working with Luminate. They were professional, responsive, and made the entire process smooth and stress-free.”

Qaiser

“The whole Luminate team really pushed through when we needed to get things done on a timeline. I was really impressed!.”

Evan

“Luminate is knowledgeable, kind, quick to respond to any question we had and was a great partner in the process.”

Joan

WE BELIEVE.

The home loan process doesn't have to be scary. Our team is here to help!

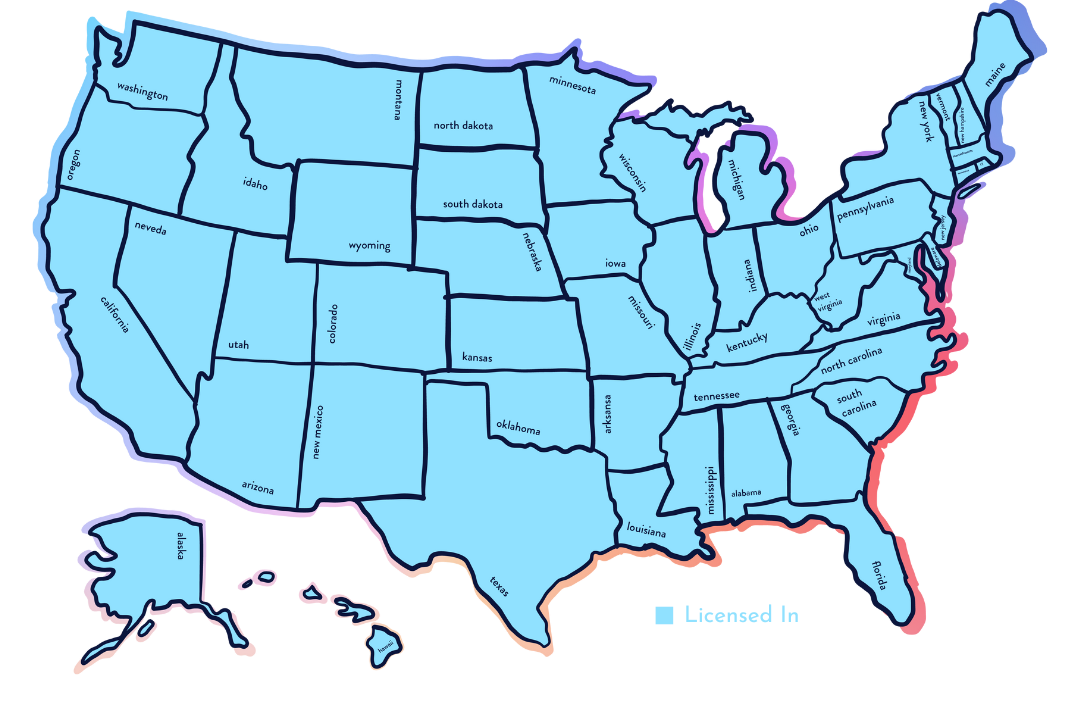

Now lending in all 50 states!