The Golden Rules of Budgeting

For those who want to get out of debt, pay off a mortgage loan or save up for a nice vacation, there are two ways to accomplish this. Both options allow you to take control of your spending.

The 50/20/30 rule is great for those who want to follow a simple way for budgeting. The Envelope System is best for those who have a tendency to overspend and need a rigid system in order to get their budget back on track.

Creating a budget doesn’t have to be scary or overly restrictive. A good budgeting plan will help you become conscious of your spending and live within your means. If done correctly, you will have an easier time paying off your mortgage loans.

What is the Principle of a 50/20/30 Budget?

The 50/20/30 numbers are a percentage breakdown of how much you can safely spend, and how much you need to save in order to pay important expenses.

The 50/20/30 rules are as follows:

- 50% of your income should be set aside for Needs

- 30% of your income is for Wants

- 20% of your income goes straight into Savings & Investing

Needs / Essentials

Essentials include items, such as your rent or mortgage loans, and auto insurance. These are expenses you can’t forgo. You have to pay them. There’s no getting around it. (But, your gym membership or spa day does not count!)

The amount that you spend on these items should total no more than 50 percent of your pay.

Savings & Investing

After your needs are taken care of, the 50/20/30 budgeting method prioritizes savings. You need to save for your future, especially if you are looking to take out a mortgage for a new home or a new car.

It’s also smart to save in case there are any sudden emergencies.

Wants

Whatever is left over after you spend your income on needs and savings is for you to spend as you please. This money can be used towards your lifestyle, such as buying a new cell phone or going to dinner on date night.

This is the hardest part. You probably spend more on your “wants” than you think you do. It’s imperative to create a budget for your personal wants.

Although it takes a lot of discipline, the 50/20/30 rule has been shown to help homeowners and future homeowners to save, pay off their mortgage loan and have some extra money to spend.

The Envelope System

The envelope system is meant for people who have a really hard time saving money and need a budgeting plan. Maxing out credit cards with a simple swipe of a card seems all too easy in the moment.

With this system, you are far more restrained in your spending when you pull money (not plastic) out of your wallet.

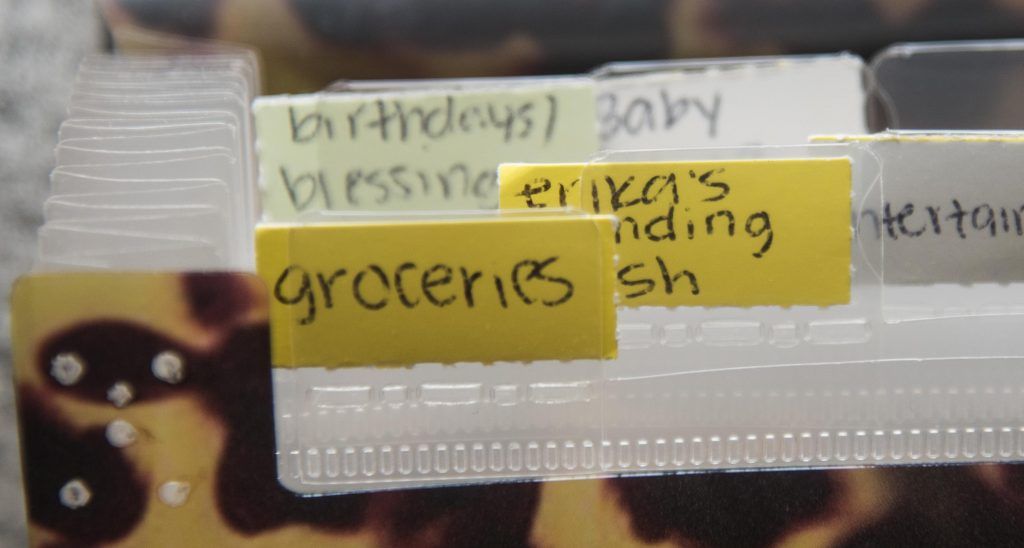

The first step is to withdraw all the money you planned to spend that month in cash, then split it into individual envelopes for all your expenses.

If you run out of money, you won’t have many options. You will have to wait until next month, or if you are in a jam, you can move money from another envelope.

Organizing your cash into envelope is one of the greatest advantages of the Envelope System. It forces you to think twice about spending $100 on a new comforter.

Do you really need it, or is it because you really want it? Maybe this will give you some insight on how much you overspend, and if you even needed the item you wanted to purchase in the first place.

I hope these budgeting tactics will help you save up!

The post The Golden Rules of Budgeting appeared first on Owings Mills & Lutherville Mortgage.

Are You Ready to Get the Ball Rolling on Your Mortgage?

Get in Touch With a Mortgage Expert

NMLS# 150953

© 2024 All Rights Reserved | Luminate Home Loans, Inc.