Weekly Newsletter – July 31, 2017

Weekly Review

The stock market ended the week “mixed” although the Dow Jones Industrial Average, the NASDAQ Composite Index, and the S&P 500 Index all reached new all-time highs during the week. Bond prices ended the week a little lower with yields modestly rising.

Although there were several significant economic reports released during the week including the latest monetary policy statement from the Federal Reserve (FOMC), the financial markets largely shrugged off these news events.

The Fed’s latest policy directive kept the fed funds target range between 1.00% and 1.25% as widely expected.

More importantly, though, the Fed signaled its intentions of beginning to reduce its bloated balance sheet by reducing its holdings of mortgage-backed securities and longer-dated Treasury notes “relatively soon.”

Most analysts took this to mean the Fed would begin this process in September or October resulting in upward pressure on long-term interest rates. Anyone in the real estate market looking to buy a hom e should be aware of this as it appears mortgage rates may be heading higher in the not too distant future.

As a result of the Fed’s FOMC meeting last Wednesday, the fed funds futures market suggests the January FOMC meeting as next most likely time for another 25 basis point rate-hike announcement with an implied probability of 50.1%.

The week’s economic data were “mixed” with July Consumer Confidence reaching a higher than forecast reading of 121.1 versus 116.8 expected. Manufacturing was less encouraging as June Durable Goods Orders excluding transportation came in at 0.2% when economists were expecting a reading of 0.5%.

Moreover, the first release of 2 nd Quarter GDP disappointed with an annualized economic growth rate of 2.6% when economists had predicted an expansion of 2.8%.

In housing, the Federal Housing Finance Agency (FHFA) reported their seasonally adjusted monthly House Price Index (HPI) increased 0.4% in May with housing prices up by 6.9% on an annual basis.

Additionally, the S&P CoreLogic Case-Shiller U.S. National Home Price Index increased 5.6% in May to match the same increase as April.

David Blitzer, S&P Dow Jones Indices managing director and chairman of the index committee, remarked “Home prices continue to climb and outpace both inflation and wages.

Housing is not repeating the bubble period of 2000 to 2006: price increases vary across the country unlike the earlier period when rising prices were almost universal; the number of homes sold annually is 20% less today than in the earlier period and the months’ supply is declining, not surging.

The small supply of homes for sale, at only about four months’ worth, is one cause of rising prices. New home construction , higher than during the recession but still low, is another factor in rising prices.”

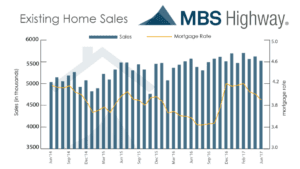

Meanwhile, Existing Home Sales fell 1.8% in June to a seasonally adjusted annual rate of 5.52 million versus 5.58 million forecast, largely due to low inventories. The median existing home price increased 6.5% to $263,800, the 64 th straight month of year-over-year gains.

The homes for sale inventory is now 7.1% lower than the same period a year ago with the unsold inventory at a 4.3-month supply at the current sales rate. First-time buyers were 32% of sales in June, down from 33% in May.

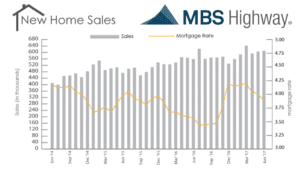

Furthermore, New Home Sales for June were reported at a seasonally adjusted annual rate of 610,000 to match the consensus forecast. The median sales price fell 3.4% to $310,800 for the month, but average sales price rose 4.2% to $379,500.

The new homes for sale inventory now stands at a 5.4-months’ supply with the June sales rate with homes priced under $400,000 accounting for 69% of new homes sold during the month of June.

Mortgage application volume increased during the week ending July 21. The Mortgage Bankers Association (MBA) reported their overall seasonally adjusted Market Composite Index (application volume) gained 0.4%. The seasonally adjusted Purchase Index fell 2.0% from the prior week while the Refinance Index increased 3%.

Overall, the refinance portion of mortgage activity increased to 46.0% of total applications from 44.7% in the prior week. The adjustable-rate mortgage share of activity increased to 6.8% of total applications from 6.7%.

According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance fell to 4.17% from 4.22% with points increasing to 0.40 from 0.31.

For the week, the FNMA 3.5% coupon bond lost 10.9 basis points to close at $102.92. The 10-year Treasury yield increased 5.31 basis points to end at 2.2906%.

Stocks ended the week mixed with the NASDAQ and S&P 500 indexes slipping marginally lower while the Dow Jones Industrial Average marched higher. However, all three of these major indexes reached new all-time highs during the week.

The Dow Jones Industrial Average rose 250.24 points to close at 21,830.31. The NASDAQ Composite Index dropped 13.07 points to close at 6,374.68 and the S&P 500 Index lost 0.44 points to close at 2,472.10.

Year to date on a total return basis, the Dow Jones Industrial Average has gained 10.46%, the NASDAQ Composite Index has advanced 18.42%, and the S&P 500 Index has risen 10.42%.

This past week, the national average 30-year mortgage rate rose to 4.04% from 4.00%; the 15-year mortgage rate increased to 3.33% from 3.29%; the 5/1 ARM mortgage rate decreased to 3.17% from 3.18%; and the FHA 30-year rate rose to 3.75% from 3.65%. Jumbo 30-year rates increased to 4.33% from 4.29%.

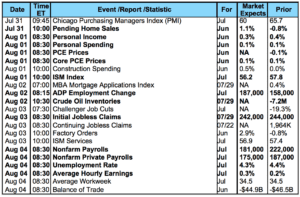

Economic Calendar – for the Week of August 1, 2017

Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

Mortgage Rate Forecast with Chart – FNMA 30-Year 3.5% Coupon Bond

The FNMA 30-year 3.5% coupon bond ($102.92, -10.9 bp) traded within a 53 basis point range between a weekly intraday low of $102.50 on Wednesday and a weekly intraday high of $103.03 on Monday before closing the week lower at $102.92 on Friday.

Bond prices fell Monday and Tuesday before bouncing back the remainder of the week. The initial move lower sent the bond below several close-by support levels that were reclaimed by week’s end. A new buy signal was triggered by Friday’s trading action, and the bond is not yet overbought, so we could see a test of overhead resistance at the 50-day moving average.

A move above this level should result in a slight improvement in mortgage rates, but if the bond is turned away from this level, we could see a slight deterioration in rates. Market direction may not be fully determined until Friday with the arrival of the week’s most significant economic report – the July Employment Situation Summary (Jobs) report.

The post Weekly Newsletter – July 31, 2017 appeared first on Owings Mills & Lutherville Mortgage.

Are You Ready to Get the Ball Rolling on Your Mortgage?

Get in Touch With a Mortgage Expert

NMLS# 150953

© 2024 All Rights Reserved | Luminate Home Loans, Inc.