Weekly Newsletter – July 24, 2017

Weekly Review

The stock market continued its advance with the NASDAQ Composite and S&P 500 Indexes reaching new all-time highs during the week while the Dow Jones Industrial Average slipped slightly lower.

Favorable earnings reports among technology and internet companies helped to boost the NASDAQ while a rally in crude oil prices aided energy sector stocks.

The bond market enjoyed moderate price increases with falling yields despite some favorable economic reports. Initial jobless claims fell by 15,000 during the week ending July 15 to 233,000 to reach their lowest level in two months, suggesting continuing strength in the labor market.

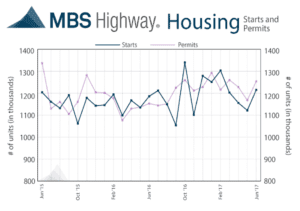

Also, there were a couple of strong reports from the housing sector including the latest report on Housing Starts and Building Permits.

The Commerce Department surprised economists by reporting a rebound in homebuilding during June as Housing Starts surged 8.3% to a seasonally adjusted annual rate of 1.215 million units, the highest level since February. Both single-family and multi-family construction increased.

Economists had forecast an increase in June Housing Starts to 1.160 million units from May’s upwardly revised reading of 1.122 million. Although this was a welcome sign after seeing three straight months of declining Starts, construction activity remains constrained by rising lumber prices and land and labor shortages.

Meanwhile, Building Permits increased 7.4% to a seasonally adjusted annual rate of 1.254 million to exceed the consensus forecast of 1.196 million.

Mortgage application volume increased during the week ending July 14. The Mortgage Bankers Association (MBA) reported their overall seasonally adjusted Market Composite Index (application volume) gained 6.3%. The seasonally adjusted Purchase Index increased 1.0% from the prior week while the Refinance Index increased 13%.

Overall, the refinance portion of mortgage activity increased to 44.7% of total applications from 42.1% in the prior week. The adjustable-rate mortgage share of activity was unchanged at 6.7% of total applications.

According to the MBA, the average contract interest rate for 30-year fixed-rate mortgages with a conforming loan balance remained unchanged at 4.22% with points decreasing to 0.31 from 0.40.

For the week, the FNMA 3.5% coupon bond gained 40.6 basis points to close at $103.03. The 10-year Treasury yield decreased 9.44 basis points to end at 2.2375%. Stocks ended the week mixed with the NASDAQ and S&P 500 indexes modestly higher while the Dow slipped slightly lower.

The Dow Jones Industrial Average fell 57.67 points to close at 21,580.07. The NASDAQ Composite Index advanced 75.28 points to close at 6,387.75 and the S&P 500 Index gained 13.27 points to close at 2,472.54.

Year to date on a total return basis, the Dow Jones Industrial Average has gained 9.20%, the NASDAQ Composite Index has advanced 18.66%, and the S&P 500 Index has risen 10.44%.

This past week, the national average 30-year mortgage rate fell to 4.00% from 4.06%; the 15-year mortgage rate decreased to 3.29% from 3.34%; the 5/1 ARM mortgage rate decreased to 3.18% from 3.22%; and the FHA 30-year rate fell to 3.65% from 3.75%. Jumbo 30-year rates decreased to 4.29% from 4.35%.

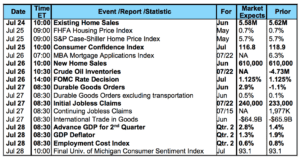

Economic Calendar – for the Week of July 24, 2017

Economic reports having the greatest potential impact on the financial markets are highlighted in bold.

Mortgage Rate Forecast with Chart – FNMA 30-Year 3.5% Coupon Bond

The FNMA 30-year 3.5% coupon bond ($103.03, +40.6 bp) traded within a 48 basis point range between a weekly intraday low of $102.59 on Monday and a weekly intraday high of $103.08 on Friday before closing the week higher at $103.03.

Bond prices rallied during the week to move above overhead resistance found at the 38.2% Fibonacci retracement level (102.806); the 200-day moving average (102.83); the 25-day moving average (102.84); and the 50-day moving average (102.92). These levels now revert back to support levels while resistance levels are now found at 103.20 and 103.53.

The chart suggests the bond can continue to rise higher toward resistance as the slow stochastic oscillator shows the bond is not yet overbought. Should this scenario play out in the coming week as the chart suggests, it should lead to a slight improvement in mortgage rates.

The post Weekly Newsletter – July 24, 2017 appeared first on Owings Mills & Lutherville Mortgage.

Are You Ready to Get the Ball Rolling on Your Mortgage?

Get in Touch With a Mortgage Expert

NMLS# 150953

© 2024 All Rights Reserved | Luminate Home Loans, Inc.